Navigating customs clearance can seem daunting, especially for beginners in international trade. Yet, it’s a critical step for smooth import/export operations—delays or errors can lead to costly penalties. In Saudi Arabia, where Vision 2030 is accelerating economic growth and cross-border trade, understanding the customs process (إجراءات التخليص الجمركي) is more important than ever.

This guide simplifies customs clearance in Saudi Arabia (التخليص الجمركي في السعودية) for newcomers, covering:

- Customs Clearance Steps (خطوات التخليص الجمركي)

- Required documents (المستندات المطلوبة)

- Customs regulations (اللوائح الجمركية)

Whether you’re importing goods (استيراد البضائع) or exporting (تصدير البضائع), we’ll help you master the process efficiently.

What is Customs Clearance? (التخليص الجمركي)

Customs clearance (التخليص الجمركي) is the mandatory process of clearing goods through Saudi Customs (الجمارك السعودية) for import (استيراد) or export (تصدير). It involves submitting documents, paying customs duties (الرسوم الجمركية), and complying with local regulations to ensure legal trade.

Why It Matters:

✔ Avoid delays (تجنب التأخير) and costly penalties.

✔ Ensure smooth release of shipments (الشحنات).

✔ Comply with Saudi trade laws (القوانين التجارية السعودية) under Vision 2030.

The Saudi Arabian Customs Landscape: Key Players & Digital Platforms

Navigating Saudi Arabia’s customs system requires understanding its key authorities and digital transformation:

- ZATCA (هيئة الزكاة والضريبة والجمارك)

The primary regulator overseeing customs, taxes, and trade compliance under Vision 2030.

- FASAH Platform (نظام فسح)

The 2024/2025 unified digital system for all clearance processes:

- Submit documents electronically (إلكترونيًا).

- Track shipments in real-time.

- Faster processing (تخليص أسرع) and 100% paperless.

- SASO (الهيئة السعودية للمواصفات)

Ensures imported goods meet Saudi standards (المواصفات السعودية).

- SFDA (هيئة الغذاء والدواء)

Mandatory for food, medicine, and medical devices.

- CITC (هيئة الاتصالات)

Approves telecom and IT equipment

Pre-Shipment Essentials: Laying the Groundwork

Before shipping goods to Saudi Arabia, ensure you complete these critical steps to avoid customs delays:

Register as an Importer/Exporter (التسجيل كاستيراد/تصدير)

- Mandatory FASAH Registration:

All businesses must register on the FASAH platform (نظام فسح).

- Required Documents:

- Valid Commercial Registration (السجل التجاري)

- VAT Certificate (شهادة ضريبة القيمة المضافة)

- Importer/Exporter Code (IEC) (رقم المستورد/المصدر)

- 2025 Update:

Individual importers can now register for small-scale shipments (up to SAR 50,000 value).

Classify Your Goods (تصنيف البضائع)

- Determine the HS Code (التعريفة الجمركية) for accurate duty calculation.

- Use ZATCA’s online tariff database for verification.

Verify Restricted/Prohibited Items(2025 updated)

- Check SASO (الهيئة السعودية للمواصفات) and SFDA (هيئة الغذاء والدواء) lists.

- Common restricted items: Drones, certain medicines, and religious materials.

Product Classification (HS Codes)

- Why It Matters:

- The Harmonized System (HS) code determines your applicable customs duties (الرسوم الجمركية) and regulations.

- Misclassification leads to delays, fines (غرامات), or shipment rejection.

- How to Classify:

- Use ZATCA’s online tariff database or consult a customs broker (وسيط جمركي).

- Example: Smartphones fall under HS 8517.12.00 (15% duty).

Prohibited & Restricted Items (2025 Updates)

- Strictly Prohibited:

- Narcotics, gambling equipment, drones without CITC approval, and certain religious materials.

- Restricted (Require Permits):

- Used/refurbished electronics (SASO approval required).

- Medical devices (SFDA pre-clearance).

- Food products (SFDA certification).

SASO & SABER Platform (2025 Critical Update)

- New Rule (Effective Jan 1, 2025):

- No shipment clears Saudi Customs without:

- Product Certificate of Conformity (PCoC) – Confirms compliance with Saudi standards.

- Shipment Certificate of Conformity (SCoC) – Issued per shipment via SABER(منصة سابر).

- No exceptions:

- No shipment clears Saudi Customs without:

Undertaking letters or post-arrival submissions no longer accepted.

Advance Cargo Declaration (ACD) – Mandatory Since 2024

Key Requirements:

- Submission Deadline: Must be filed at least 24 hours before shipment departure (for both sea and air cargo).

- Where to Submit: Through ZATCA’s FASAH platform or via an authorized customs broker.

- Data Required:

- HS codes

- Shipper/consignee details

- Cargo description and value

- Bill of lading/airway bill number

Why Compliance is Critical:

Penalties for Non-Compliance:

- Customs holds on shipments

- Fines up to SAR 10,000 (approx. $2,666)

- Delays in clearance (additional storage fees may apply)

Essential Documents for Customs Clearance in Saudi Arabia

Ensuring 100% accurate and complete documentation is critical for smooth customs clearance in Saudi Arabia. Missing or incorrect paperwork can lead to delays, fines (up to SAR 50,000), or shipment rejection.

Mandatory Customs Clearance Documents (2024-2025 Requirements)

- Commercial Invoice (فاتورة تجارية)

- Must be attested (if required) and in Arabic or bilingual (Arabic + English).

- Include:

- Full product description, HS Code, quantity, value (in SAR/USD).

- Country of origin, Incoterms (e.g., FOB, CIF).

- 2024 Rule: B2B invoices must comply with ZATCA’s Phase 2 e-invoicing (فاتورة إلكترونية) via FATOORAH—non-compliance risks SAR 5,000 fines.

- Certificate of Origin (COO) (شهادة المنشأ)

- Issued by the exporting country’s Chamber of Commerce.

- GCC Format: Required for preferential tariffs under the GCC Common Market.

- Bill of Lading (B/L) (بوليصة الشحن) or Air Waybill (AWB)

- Original or certified copy (no digital scans accepted).

- Must match Advance Cargo Declaration (ACD) data.

- Packing List (قائمة التعبئة)

- Details per package: weight, dimensions, contents.

- SABER Certificates (2025 Mandate)

- PCoC (Product Certificate of Conformity): Proves compliance with SASO standards.

- SCoC (Shipment Certificate of Conformity): Issued per shipment via SABER.

- Import License/Permit (ترخيص الاستيراد)

- Required for restricted items:

- Medical products: SFDA approval.

- Chemicals: Royal Commission permit.

- Required for restricted items:

Tips for a Smooth Customs Clearance in Saudi Arabia

Navigating Saudi customs can be complex, but these proven strategies will help ensure hassle-free clearance:

1. Engage a Licensed Customs Broker (وسيط جمركي مرخص)

- They handle paperwork, classify HS codes, and stay updated on ZATCA/SASO changes.

- Saves Time: Reduces risk of errors leading to SAR 10,000+ fines.

2. Double-Check Document Accuracy

- Ensure consistency across:

- Commercial invoice ⇨ Bill of Lading ⇨ SABER certificates.

- Common mistake: Mismatched weights/values trigger customs inspections.

3. Obtain Certifications Early

- SABER (PCoC/SCoC): Start 3+ weeks pre-shipment—testing takes time.

- Special Permits: SFDA (food/medicine), CITC (electronics).

4. Monitor Regulatory Updates

- Subscribe to ZATCA alerts for e-invoicing/SABER changes.

- 2025 Watch: Stricter SASO conformity checks.

5. Proper Packaging & Labeling

- Arabic Labels: Product name, ingredients, origin (e.g., “صنع في الصين”).

- Barcode Compliance: Required for retail goods.

6. Maintain Records for 5+ Years

- Digital + physical copies of:

- Customs declarations, invoices, SABER certificates.

- Audit Risk: ZATCA conducts random checks.

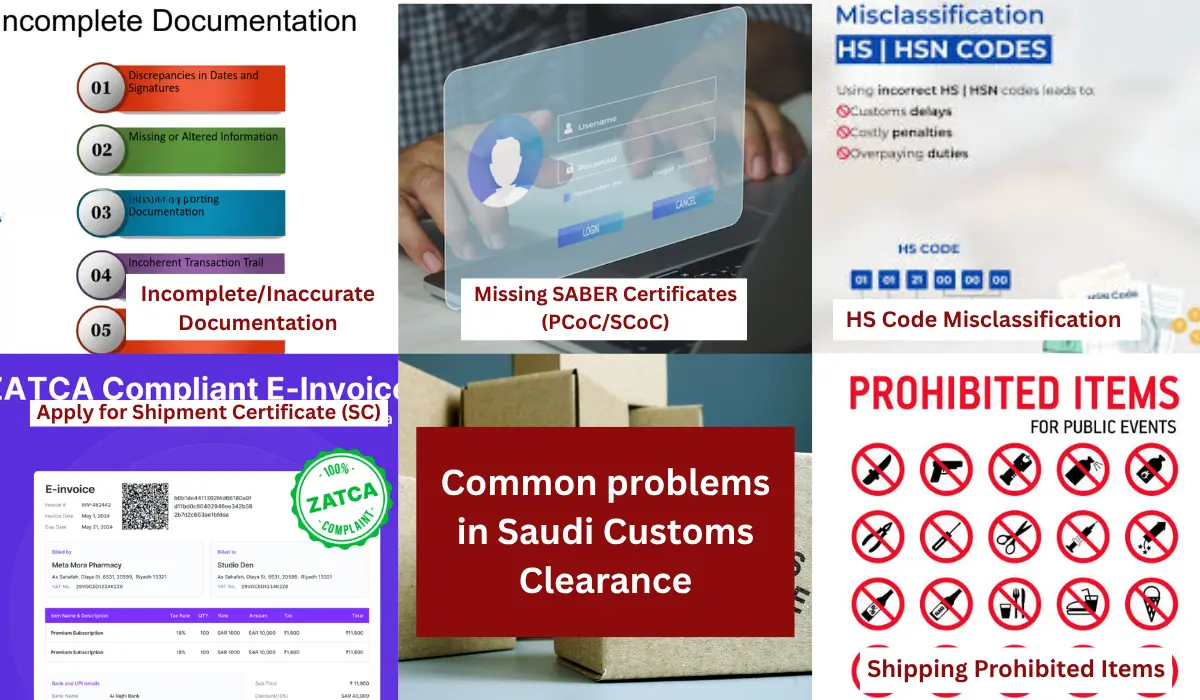

Common problems in Saudi Customs Clearance

- Incomplete/Inaccurate Documentation – Missing stamps, mismatched values, or unsigned forms cause immediate delays.

- Missing SABER Certificates (PCoC/SCoC) – Shipments without 2025-mandated SASO certifications will be rejected.

- HS Code Misclassification – Incorrect codes trigger wrong duty fees + 20% penalties.

- E-Invoicing Non-Compliance – Non-ZATCA-approved FATOORAH invoices risk SAR 5,000 fines.

- Shipping Prohibited Items – Drones, certain medicines, or religious materials lead to confiscation + legal action.

Conclusion

While Saudi customs clearance may seem complex, proper preparation—accurate documents, SABER compliance, and expert guidance—ensures smooth trade. Efficient clearance accelerates your business growth in Saudi Arabia’s booming market under Vision 2030.Need Help?

Contact Radhi Custom Clearance Co. for end-to-end support, from HS code classification to SABER certification. Stay tuned for more Saudi trade insights!

Add a Comment