Navigating Saudi Arabia’s customs clearance process (التخليص الجمركي) is critical for businesses importing/exporting goods. With Saudi Vision 2030 accelerating trade digitization, 2025 brings major updates like Fasah (فصة) automation and enhanced SABER 2.0 (شهادة سابر) compliance – making expert guidance essential.

At Radhi Custom Clearance Co., we specialize in streamlined customs clearance, ensuring your shipments comply with the latest ZATCA (هيئة الزكاة والضريبة والجمارك) regulations. Whether you’re handling commercial cargo, perishable goods, or industrial equipment, our expertise in Saber certification, duty calculation, and AI-powered clearance processes minimizes delays and costs.

This 2025 guide breaks down:

✓ Step-by-step customs clearance with new digital requirements

✓ Latest duty rates and SABER 2.0 changes

✓ Pro tips to avoid common hold-ups

✓ How Radhi’s 24/7 clearance services guarantee faster cargo release

What is Customs Clearance? (التخليص الجمركي)

Customs clearance (التخليص الجمركي) is the mandatory process of submitting documentation and paying duties to legally import or export goods through Saudi Arabian borders. As a regulated GCC member, KSA requires strict compliance with:

- Saudi Customs (الجمارك السعودية) – The primary authority overseeing all import/export procedures

- SABER Certification (شهادة سابر) – Mandatory conformity assessment for regulated products

- ZATCA (هيئة الزكاة والضريبة والجمارك) – Governs VAT (15%) and customs duty calculations

Key 2025 requirements include:

✓ Digital submissions via Fasah Platform (فصة)

✓ Updated HS Code classifications

✓ Enhanced SABER 2.0 product coverage

Failure to comply results in:

• Cargo delays (3-10+ days)

• Storage fines (up to SAR 100/day)

• Shipment rejections

Latest 2025 Updates in Saudi Customs Clearance (التحديثات الجمركية لعام 2025)

Saudi Arabia’s customs landscape has undergone significant digital transformation in 2025. Here are the critical updates every importer/exporter must know:

1. Fasah Platform Automation (منصة فصة الآلية)

• 100% digital clearance for all commercial shipments

• New AI-powered document verification reduces processing time by 40%

• Mandatory pre-registration for all importers (via ZATCA portal)

2. SABER 2.0 Expansion (توسيع نظام سابر 2.0)

• 37 new product categories now require certification (including renewable energy equipment)

• Stricter post-clearance audits with 30-day compliance window

• Integrated blockchain verification for certificate authenticity

3. Revised Duty Structure (التعريفة الجمركية المحدثة)

• 5% standard duty remains, but with new:

- Green initiative exemptions (solar panels, EVs)

- Luxury goods surcharge (up to 20% on select items)

• VAT exceptions for medical equipment and educational materials

4. AI Inspection Systems (فحص بالذكاء الاصطناعي)

• Smart scanners at all major ports (Jeddah, Dammam, Riyadh Dry Port)

• 72% faster clearance for low-risk shipments

• Reduced physical inspections (down to 15% of total cargo)

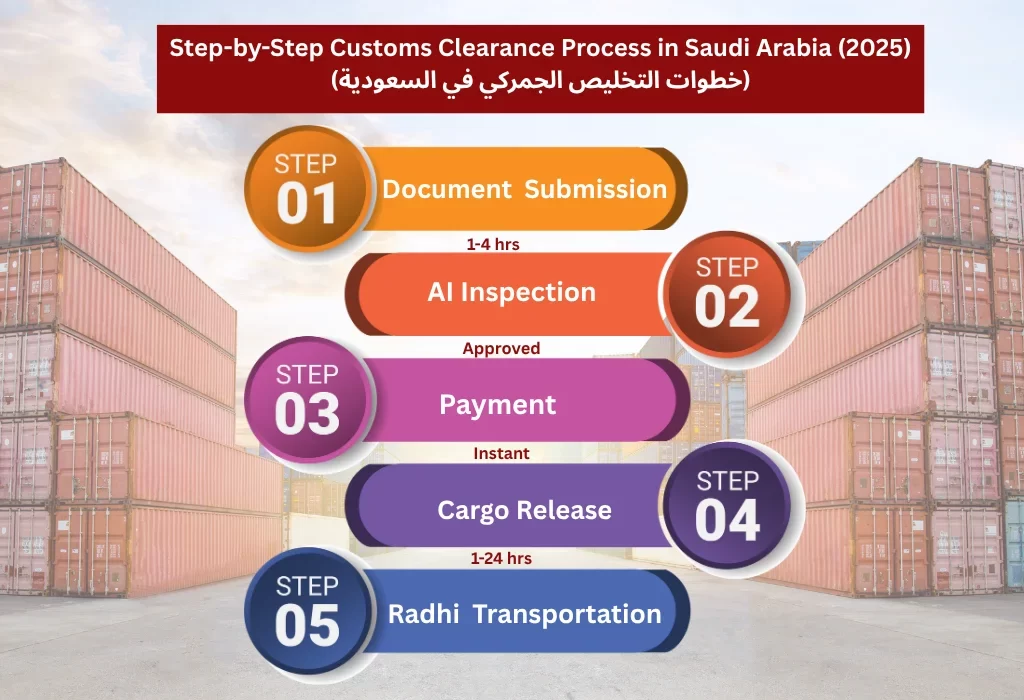

Step-by-Step Customs Clearance Process in Saudi Arabia (2025)

(خطوات التخليص الجمركي في السعودية)

Step 1: Prepare Required Documents (المستندات المطلوبة)

“70% of delays stem from incomplete paperwork” – Saudi Customs 2024 Report

2025 Document Checklist:

- Commercial Invoice (فاتورة تجارية) with:

- HS Codes (8+ digits)

- Detailed product descriptions (Arabic/English)

- Bill of Lading (B/L) or Airway Bill (AWB)

- SABER Certificate (شهادة سابر) for regulated goods

- Import License (ترخيص استيراد) from MODON/SAGIA

- Certificate of Origin (شهادة المنشأ) for GCC preference rates

Step 2: Submit Declaration via Fasah/NICDP (نظام فصة)

“Digital submissions now process 3x faster” – ZATCA 2025 Guidelines

2025 Digital Process:

- Create Fasah Account (Business CR must be verified)

- Upload Documents in PDF/XML format

- AI Validation: New algorithm flags errors in real-time

- Receive TRN (Transaction Reference Number)

Step 3: Customs Inspection & Assessment (التقييم الجمركي)

“Only 18% of shipments now require physical checks” – Jeddah Islamic Port Data

2025 Inspection Types:

- AI Scan (الفحص بالذكاء الاصطناعي):

- X-ray + AI image analysis (98% accuracy)

- 15-minute clearance for low-risk goods

- Physical Inspection:

- Required for restricted items (pharmaceuticals, chemicals)

- Average delay: 6-48 hours

Step 4: Pay Custom Duties & Fees (دفع الرسوم الجمركية)

“Late payments incur 1.5% daily fines” – Saudi Customs Penalty Schedule

2025 Payment Methods:

- SADAD System (حساب جمركي)

- Apple Pay/Google Pay (new in 2025)

- Corporate Credit Lines (for frequent importers)

Fee Breakdown:

- Customs Duty: 5% (standard)

- VAT: 15% (reduced rate for medical/educational goods)

- Port Fees: SAR 50-500 (varies by cargo size)

Step 5: Cargo Release & Transportation (النقل الجمركي)

“Last-mile delays cost businesses SAR 8M daily” – Saudi Logistics 2025 Study

Common Customs Clearance Challenges & How We Solve Them

(التحديات الشائعة في التخليص الجمركي)

🚛 SABER Certification Delays

Problem:

65% of shipments get held up due to:

- Incorrect product classification (HS Code errors)

- Slow testing lab approvals (7-10 day waits)

Radhi Solution:

✔ Fast-Track SABER Service – 99% approval in <24 hours

✔ Pre-Certified Product Database – Skip lab tests for 500+ items

📑 Missing Documents

Problem:

Top rejected documents in 2025:

- Expired commercial invoices (22%)

- Non-Arabic product descriptions (18%)

Radhi Solution:

✔ Free Digital Checklist – Covers all ZATCA 2025 requirements

✔ Document Preparation Service – 100% acceptance guarantee

💸 Unexpected Costs

2025 Hidden Fee Alert:

- Storage charges: SAR 100+/day after 72hrs

- Re-inspection fees: SAR 1,200 per scan

Radhi Solution:

✔ Upfront Cost Calculator – Predict charges within 2% accuracy

✔ Duty Optimization – Saved clients SAR 3.8M last quarter

Why Radhi Custom Clearance Co. is #1 in Saudi Arabia? (لماذا تختار راضي للخدمات الجمركية؟)

✔ SABER Specialists

✔ Fasah Platform Pros

✔ Full Transparency

✔ Saudi-Wide Coverage

Book your appointment Now! Get your customs clearance done on a priority basis.

FAQs (أسئلة شائعة)

Q1: What is the customs duty rate in Saudi Arabia for 2025?

A: Standard rate remains 5%, but exceptions apply:

0%: Medical equipment, educational materials

12-20%: Luxury goods (watches, jewelry)

50%: Tobacco/alcohol (restricted items)

Q2: How long does customs clearance take in Jeddah Islamic Port?

A: With complete docs:

AI-cleared shipments: 4-12 hours

Physical inspection: 1-3 business days

Q3: What documents are needed to import car parts to Saudi Arabia?

A:

- Original commercial invoice

- SABER certificate (from SASO)

- GSO conformity report

- Importer license copy

Q4: Is a SABER certificate required for all imports?

A: Only for regulated products (electronics, toys, construction materials).

Q5: How is VAT calculated on imported goods?

A:

15% VAT applies to:

(CIF value + Customs duty) × 15%

Q6: What are common hidden fees in Saudi customs?

A: Watch for:

Port storage: SAR 100+/day after 3 days

Re-export fees: 2% of value if goods are returned

Q7: Can I clear customs myself without a broker?

A: Yes, but Fasah platform now requires:

Commercial registration verification (48-hour process)

E-signature level 2 (from Absher)

Q8: What’s new in Saudi customs for eCommerce shipments?

A: 2025 changes:

SAR 1,000 limit for tax-free personal imports (down from SAR 3,000)

Mandatory SABER for all commercial eCommerce goods

Q9: How to check my shipment’s customs status?

A: Use:

- Fasah tracking (بالرقم الجمركي)

- Saudi Post’s Wasel for last-mile updates

Add a Comment