Master Saudi Arabia customs clearance checklist in 2025 with our expert—covering SABER, ZATCA, VAT, import docs, and trade compliance KSA.

The Gateway to the Saudi Market

In the past decade, Saudi Arabia has revolutionised its trading environment using digital platforms like FASAH and SABER to ease customs processes. The country that was once paper-intensive and slow is now in the process of becoming automated, traceable, transparent…the emerging smart logistics hub for the MENA region with Vision 2030.

If you are one of those planning to import in Saudi Arabia in the year 2025, it is very important that you know how to work through changing customs laws. The Kingdom is open for business — though only to the prepared, as Vision 2030 mandates a rapid overhaul of the economy.

With Saudi Arabia customs clearance your goods are more than just paperwork. It is about adhering to correct detail, up-to-date knowledge on new SABER and FASAH et al digital platforms being used many times for accuracy.

We’ll show you exactly how to clear your goods at KSA with lots of 2025 specific changes and make certain that you’re not left sitting on the border.

Key Updates & Latest Regulations (2025) You Must Know

The SABER Platform and Certificates of Conformity (CoC):

Effective on January 1, 2025, each shipment must be accompanied by PCOC and SCoC for Customs clearance that may only be issued via the Saudi’s (SABER) platform.

First, be registered with an account on the website for Saudi Standards (SASO), and only then register your company in the SABER portal in KSA.

Once registered, you can add your items, choose the appropriate technical regulations, and submit the Product Certificate of Conformity (PCoC) via a notified body. The Shipment Certificate of Conformity (SCoC) must be applied for separately after the shipment has been delivered. Under ZATCA customs regulations, failure to complete this before arrival can result in delays and fines.

There are no more Letters of Undertaking. Under ZATCA customs regulations, failing to obtain a CoC post-arrival is now considered a transgression.

Radhiawad can help your company step by step if you are unsure about SABER registration. Register for a consultation right away.

Customs and Updated Procedures for ZATCA

Fresh laws launched by the Zakat, Tax and Customs Authority (ZATCA):

- Simplify trade paperwork.

- Define protocols.

- Permit a 30-day delay on KSA customs charges with a bank guarantee.

It has never been more crucial for the KSA to maintain trade compliance.

VAT Regulations: 2025 Modifications

New VAT adjustments effective April 2025 bring:

- Refined criteria for virtual markets

- Conditions for a more stringent VAT group

- Streamlined refund system

To avoid hefty penalties, ensure the updated Saudi Arabia VAT matches.

New Palletization Requirements: Circular No. 6/2025

Issued by the Saudi Ports Authority, this directive:

- Every containerized delivery has to be palletized.

- Improves port safety and efficiency

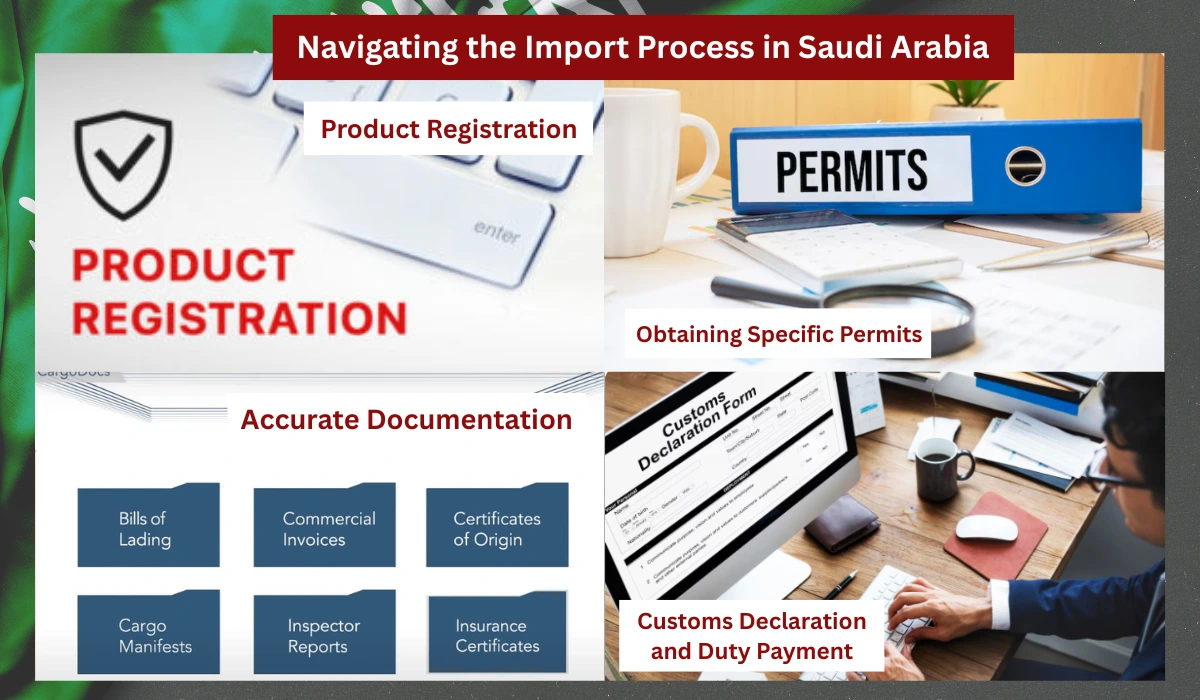

The Essential Customs Clearance Checklist

Pre-Shipment Preparation (Before the Goods Leave)

- Documentation Checklist:

- Commercial Invoice KSA:

Legally made by the Chamber of Commerce

Includes declared value, product specifics, and HS Codes.

- Certificate of Origin, Saudi Arabia:

Must be legal and based on declared data.

- Packing List:

Encompasses weight, volume, and product information

- Air Waybill / Bill of Lading:

Transport document with shipping details and consignee.

- Product & Shipment Certificates (PCoC & SCoC):

Mandatory starting in 2025

- Compliance and Labeling

- Adhere to Saudi Standards (SASO): Non-removable labeling with country of origin

- Specific products—such as food and cosmetics—could call for SFDA.

Do you require assistance in ensuring SASO compliance? Reach out today for SASO label verification services from Radhi Custom Clearance Co.!

During Transit & Arrival

- Saudi Arabia Customs Broker Engagement:

Working with a licensed customs broker ensures:

- Managing entries for the FASAH system efficiently.

- Appropriate document submission and customs categorizing

Though not required, hiring a broker is strongly advised.

- E-Declaration and FASA System

Use FASAH to:

- Store the shipping statement.

- Upload supporting paperwork

- Keep track of transportation conditions.

- Inspection and Valuation

ZATCA could manually check items.

Valuation is founded on CIF: Cost + Insurance + Freight

Post-Clearance: Final Steps & Best Practices

Lacking appropriate PCoC and labeling, a European electronics company sent items to Jeddah without verifying SASO specifications, leading to detention at the port and a penalty by ZATCA customs. The problem might have been avoided with the assistance of a Saudi Arabian customs broker.

Radhiawad ensured that KSA would be entirely trade compliant going forward, enrolled in SABER, and helped to settle the matter.

- VAT and Customs Fees KSA

- Automatic VAT at 15% is calculated.

- Obligations vary with HS Code categorization.

- Certain exemptions apply (e.g., GCC origin goods)

- Import Permit Prerequisites:

Importers should ensure they hold a valid import license for Saudi Arabia, authorized by the Ministry of Commerce.

Your Chamber of Commerce registration, which is sometimes required to verify documents such as the commercial invoice for KSA and the certificate of origin of Saudi Arabia, is directly linked to this license. Companies lacking these certifications typically have delays in customs clearance KSA.

- Common Mistakes to Avoid:

- Missing PCoC or SCoC

- Mistaken HS codes

- Insufficient or incorrect records

- Skipping the customs agent

- Failure to use pallets beginning in 2025

Conclusion

Entering Saudi Arabia in 2025 requires more than just shipping; it’s about understanding the SABER platform, adhering to ZATCA customs, and having a comprehensive checklist.

Every stage—from the Commercial Invoice to VAT payments—must be carried out appropriately.

Do you need professional assistance with your Saudi Arabian customs clearance?

Radhi Custom Clearance Co. is your reliable partner if you’re having trouble with SABER registration, missing CoCs, or need smooth ZATCA custom approvals. We streamline every step, from document legalization to using the FASAH system.

Contact Radhi Custom Clearance Co. right away to become compliant fast.

Frequently Asked Questions

- What are SABER’s PCoC and SCoC?

Through the SABER platform, one receives an SCoC per shipment and a PCoC per product; hence, these are mandatory conformity certificates.

- How does the FASAH system work?

FASAH is Saudi Arabia’s electronic customs portal where importers file declarations and supporting documents.

- In Saudi Arabia, is it necessary to employ a customs broker?

Not legally, but highly advised is using a licensed customs broker in Saudi Arabia, because the FASAH and SABER systems are pretty complex.

- For Saudi Arabia customs clearance, what documents are needed?

The commercial invoice, certificate of origin, packing list, bill of lading, and Certificate of Origin (CoO) are among the essential documents.

- How can Radhiawad help KSA with trade compliance?

With SABERregistration, document legalization, customs brokerage, and complete regulatory compliance, Radhiawad offers end-to-end help.